- Replies 216

- Views 6.3k

- Created

- Last Reply

Top Posters In This Topic

-

Snoslinger 41 posts

-

AKIQPilot 27 posts

-

Highmark 24 posts

-

Zambroski 19 posts

Popular Days

Most Popular Posts

-

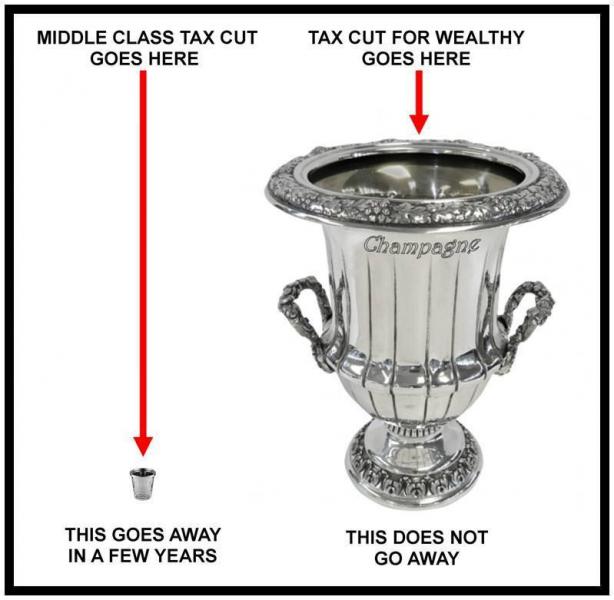

Changes to the AMT and the Estate tax

-

Seems like everyone here will benefit from Trumps tax plan.

-

3 wives , wow , that would be tough. Speaking of wives my wife ran out of her beer last night and asked if she could have one of mine . I said " sure you can , what is mine is yours, what

Featured Replies

Recently Browsing 0

- No registered users viewing this page.

Simple to use. Post up what you would save or pay in extra. Simple for those without S corp income.

http://taxplancalculator.com/

Edited by Highmark