- Replies 128

- Views 4.7k

- Created

- Last Reply

Top Posters In This Topic

-

SnowRider 20 posts

-

Sleepr2 17 posts

-

Highmark 13 posts

-

steve from amherst 10 posts

Most Popular Posts

-

I am all for it. are you for cutting all spending by 30 to 50 % or just military hell I will give you 50% if you agree to 30 percent of everything else

-

How about we start with a common sense balanced budget amendment. Here are some simple inclusions. Anytime we run a deficit congress doesn't get paid. Besides a declaration of war fr

-

33% and you put the higher ups from each department in a room together and they don't get to leave until they figure out what is really critical for operating.

Spending 21 members have voted

Featured Replies

Recently Browsing 0

- No registered users viewing this page.

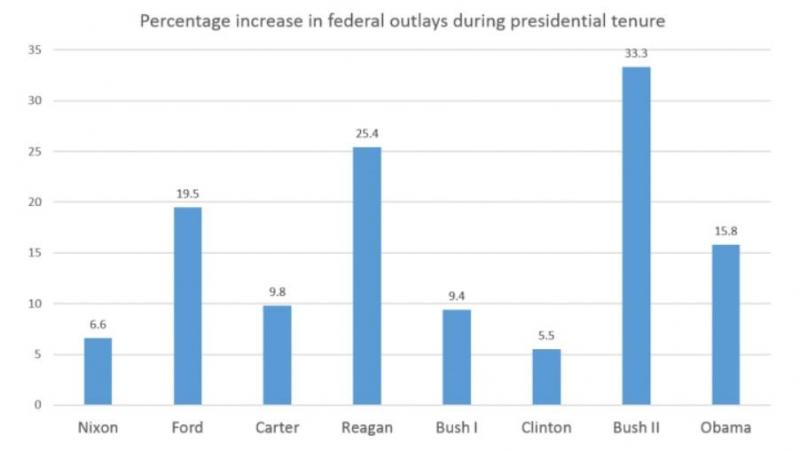

There’s a lot of chatter about cutting spending and as any intelligent person knows -so I don’t expect much from the FSCE Clown Posse - military spending accounts for a significant portion of discretionary spending - so who’s for cutting it knowing that Dump and the Repugs want to increase it....

Edited by SnowRider