Everything posted by Crnr2Crnr

-

Euro trash Exposed

must be challenging for you not to salivate like a saint bernard over the food pictures... but anyway, it's downright weird at times seeing what people post on their social media. now and then my wife will show me shit on people's Gram pages, etc and I just roll my eyes. hey, 27 fresh selfies today... that's great 👍

-

Euro trash Exposed

I'm in favor of people being jailed for posting pictures of everything they eat, buy or do everyday on social media... hey, thanks for posting another picture of your salad and your cat lady!!!

-

'Tomorrow it could be us': Marco Rubio warns Republicans not to take advantage of Wikileaks

Trump tactics...

-

Euro trash Exposed

https://www.freedomsledder.com/index.php?/search/&q=Exposed&type=forums_topic&quick=1&author=ArcticCrusher&nodes=4&search_and_or=and&sortby=relevancy everything, exposed...

-

Epstein/Maxwell client list.

Pedophiles, Pedos everywhere!

-

Deep State

it's a great deflection from actually describing it in their own words...

-

Deep State

- Pam Bondi

why don't you just tell us all the 'truth'... your truth. I'll make some popcorn... as we could all use a good laugh.- What are your thoughts on Trump attacking Brazil with Tarrifs because they didn’t vote for his buddy

- Pam Bondi

I'm all in on seeing 'the list' and everything related to Epstein... cuz Deflecting Donny seems to be opposed to it and wants everyone to forget the guy. I could give two shits who else goes down with him. 😁- Lock him up he’s a lunatic

straight from the Roy Cohn playbook... When they met, Roy said to him, ‘You might be guilty; it doesn’t matter. Go after the Justice Department. Don’t ever admit guilt.’” Trump was “totally taken” by Cohn’s advice to “‘fight it. You’ll kill them. Just deny everything and fight,’” “Donald Trump was on the ropes. There was no doubt they had discriminated. There was no doubt there was wrongdoing. And yet, Roy Cohn showed him that you can turn around a situation just by ignoring the facts and going after your attacker.” “Roy went on the offensive and said this is a victory; Trump was vindicated,” Marcus says. “He knew before anybody else did that the court of public opinion is often more important than a court of law.” “If somebody attacks him, he attacks them back, he says, ten times as hard,” says Peter Baker of The New York Times. “He’s not about diplomacy. He’s not about negotiation. He is all about the fight.” https://www.pbs.org/wgbh/frontline/article/donald-trump-roy-cohn-race-discrimination-lawsuit-fight-documentary-excerpt/ how's your MCDS today Dougie?- F1 2025

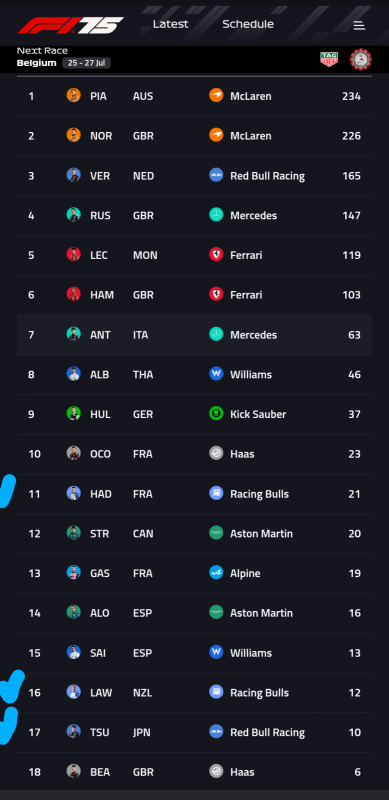

Hadjar seems more consistent than Lawson. Constructors championship points $ will likely dictate where they go from here. There's a lot of dough on the line.- Dan The Man

NBC NewsDan Bongino weighs resigning from FBI after heated confro...Bongino, the deputy director of the FBI, “is out of control furious,” one source told NBC News. Another said he did not report to work on Friday. what a f'ng clown show...- 'I voted for none of this'

Andrew Schulz turns on Trump over budget, wars, Epstein documents https://www.foxnews.com/media/andrew-schulz-turns-trump-over-budget-wars-epstein-documents-i-voted-none-this who is this guy?- Hegseth...

cringe as fuck... welcome to Celebrity Apprentice 2.0- Jeffrey Epstein kept ‘meticulously detailed’ diaries which could come back to haunt his powerful pals

when you've lost Laura Looney... were the magatards lied to? there's got to be a list... maybe some videos, a journal... something... ANYTHING!!!!- Cunt2Cunt and his cousin MainCunt

- Cunt2Cunt and his cousin MainCunt

- Cunt2Cunt and his cousin MainCunt

- Jeffrey Epstein kept ‘meticulously detailed’ diaries which could come back to haunt his powerful pals

- And the Epstein case silently goes away.

some good stuff in the archives today...- Trump, Epstein connections

pity bump- Epstein/Maxwell client list.

- Pam Bondi