Everything posted by Highmark

-

NYTimes has gotten ahold of Trump's tax returns.

I believe there is.....its called the IRS. If there was concern on his taxes from 20 years ago I'm sure there would have been litigation over it.

-

Forbes Adds It Up: Trump Is $1.1 Billion in Debt

"he" was Forbes Sr. editor Dan Alexander you fucking idiot. Reading comprehension dude.....really. Now, Forbes senior editor Dan Alexander, whose beat is covering Trump, reveals the President of the United States is $1.13 billion in debt. That’s billion with a “b.” Overall, he puts Trump’s net worth at $2.5 billion, saying his businesses are “worth an estimated $3.66 billion before debt.” Alexander clearly knows what he’s talking about, and clearly knows all of Trump’s real estate assets. The list of debt on his assets seems staggering

-

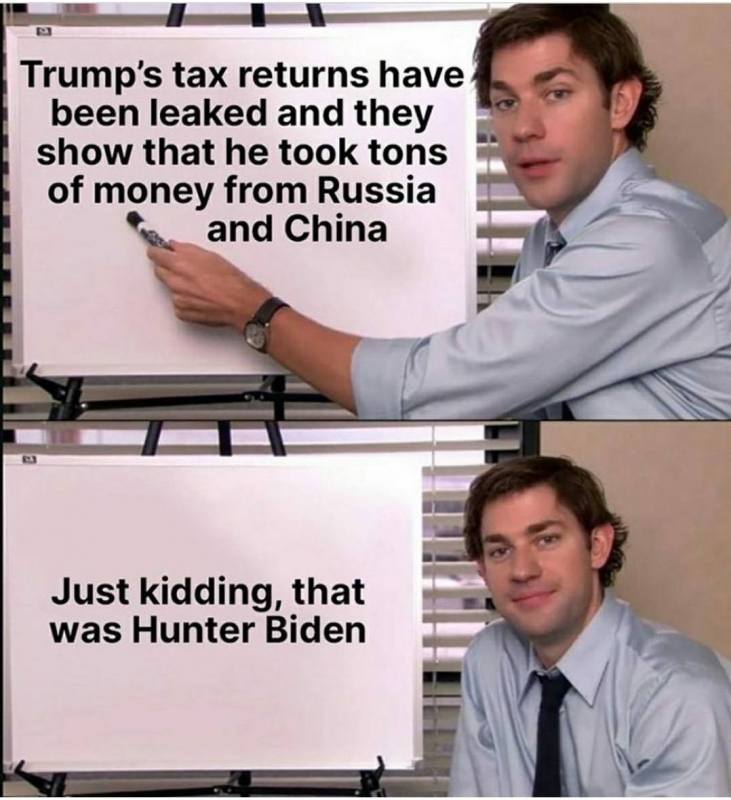

Meme thread

- Biden reads "end of quote" off the teleprompter.

Nothing to defend.....they just ignore or leave it alone.- Forbes Adds It Up: Trump Is $1.1 Billion in Debt

What's his net worth dumbass? Right from your link. Your BIL obviously never taught you anything about business. Overall, he puts Trump’s net worth at $2.5 billion, saying his businesses are “worth an estimated $3.66 billion before debt.”- Forbes Adds It Up: Trump Is $1.1 Billion in Debt

Poor MC. Deflection as usual.- Forbes Adds It Up: Trump Is $1.1 Billion in Debt

Dude if Trump owed the Russian's it would have been all over the NYT's article. What's your thoughts on Hunter getting millions from the Russian's?- The Psychopath In Chief

Right where I stopped. Like many other Trump critics, I believed- Forbes Adds It Up: Trump Is $1.1 Billion in Debt

MC you will be paying for Trump and his kids protection to travel and golf the rest of your life.- Justices Kennedy, Kavanaugh and Deutschebank

Ivanka sat next to his son so its obvious they asked him to step down.- You know what wasn't the lead headline in the Trump tax story?

- You know what wasn't the lead headline in the Trump tax story?

Russia.....because you know it would have been had their been anything there.- Biden reads "end of quote" off the teleprompter.

Please do not make this man the most powerful person in the world.- Is it legal?

For the article to be written about it or someone leaking them to the times?- Is it legal?

Lets see. Trump turned all control of his companies to other people AND donates his entire govt salary. How much taxes should he owe?- Meme thread

- But... Trump's taxes!

How about the $38 million he paid in 2005.....according to Maddow? https://time.com/4701747/donald-trump-rachel-maddow-taxes/- Is it legal?

No it should not be legal for the NYT's to publish this information and the person or person's who provided it to them should be charged and indicted. If Biden's medical records were published by the Washington Times the left would be having a fit. I see this as no different. This could backfire on the Times and push some people to vote for Trump.- Another absentee ballot application

All American's need to understand the risk of even absentee ballots. Besides the 3%+ that the post office loses (if mailed) you risk your ballot being destroyed the more people that handle it. If you vote absentee you are better off dropping it at the appropriate place in person. The best way of knowing your vote is counted still is voting in person.- Another absentee ballot application

I get its a bit strange but not considering the irrational fear the media/govt has created with COVID.- But... Trump's taxes!

You complaining about someone using legal tax avoidance methods is priceless. Fuck man can your hypocrisy get any greater.- Doomsayer's getting it wrong.

I supported initial quarantines until we got a handle on what we were dealing with and if people want to wear masks....go right on ahead. If a business requires a mask I'll wear one if I want to patronize them. The issue I have is the scare tactics used that had very little science behind the models they were pushing. Lot of truth in this quote. A person is smart. People are dumb, panicky dangerous animals and you know it.- Another absentee ballot application

Its only an absentee ballot application. This is not the concern like "mail in ballots" where everyone gets one and can vote with what they receive. I assume you still need to fill it out and ask for one.- Trump's Taxes Show He's a National Security Threat

In 2020 O'Brien was hired as a senior adviser to Michael Bloomberg's Democratic Party primaries campaign for the 2020 United States presidential election Guy was a Sr. "advoser" to Bloomberg who is paying millions in fines for felon's in Florida to get them to vote for Biden. These payments might constitute a felony.- Joe Biden Used Tax-Code Loophole Obama Tried to Plug

Must be a liberal thing eh @Mainecat. https://www.wsj.com/articles/joe-biden-used-tax-code-loophole-obama-tried-to-plug-11562779300 https://www.breitbart.com/politics/2020/09/28/joe-biden-allegedly-exploited-s-corporation-loophole-to-avoid-paying-medicare-social-security-taxes/ “How the Bidens Dodged the Payroll Tax,” was Jacobs’ headline on Aug. 10. In it, the Journal details how the Bidens set up an S-Corporation to avoid paying more than half a million dollars in taxes they would have otherwise owed. “Joe Biden responded to President Trump’s partial suspension of payroll-tax collections with a statement calling it the ‘first shot in a new, reckless war on Social Security,’” Jacobs wrote. He continued: “‘Our seniors and millions of Americans with disabilities are under enough stress without Trump putting their hard-earned Social Security benefits in doubt.’ Mr. Biden’s objections might be more persuasive had he and his wife, Jill, not gone out of their way to avoid funding seniors’ entitlement benefits. According to their tax returns, in 2017 and 2018 the Bidens and his wife Jill avoided payroll taxes on nearly $13.3 million in income from book royalties and speaking fees. They did so by classifying the income as S-corporation profits rather than taxable wages.” Jacobs continued in his expose by noting the corporation the Bidens established to avoid paying the payroll taxes on millions of dollars in income amounts to more than half a million dollars in taxes that Joe and Jill Biden did not pay. “According to the Urban Institute, a couple featuring one high earner and one average earner, retiring this year, will have paid a total of $209,000 in Medicare taxes during their working lives,” Jacobs wrote. “The Bidens avoided paying nearly twice that much in Medicare taxes during two years. The maximum payroll tax affected by Mr. Trump’s suspension is $1,984—less than 1/250th of the amount the Bidens avoided in 2017-18. The Bidens didn’t avoid any Social Security tax, which applied only to the first $127,200 of income in 2017 and $128,400 in 2018. But they would under Mr. Biden’s tax plan, which would impose the 12.4% Social Security tax on income over $400,000; the same loophole he used in 2017-18 would shield him from his own tax. And how can Mr. Biden claim to protect Medicare and ObamaCare when he avoided more than $500,000 in taxes that fund the two programs? The media have largely ignored the Bidens’ accounting legerdemain, fixating on Mr. Trump’s tax returns instead. But at least the president isn’t looking to raise taxes on everyone else.” The Wall Street Journal is hardly the only outlet to illustrate how the Bidens used this tax code loophole of creating an S-Corporation to save themselves from paying hundreds of thousands—perhaps now millions—of dollars in taxes over the years. CNBC’s Darla Mercado in 2019 wrote about it explaining to her readers how they can use the same loopholes Biden did to avoid paying their taxes. - Biden reads "end of quote" off the teleprompter.