-

Posts

48,828 -

Joined

-

Last visited

-

Days Won

31

Content Type

Profiles

Forums

Events

Posts posted by ArcticCrusher

-

-

-

1 minute ago, Deephaven said:

Nobody is seeing anything you state. You can change that. Go to your thread and try for once or be a pussy and don't.

Go read Orwell's 1984. You're living in it. It wasn't supposed to be an instruction manual.

You're just too stupid and have blind trust for your government.

-

People are seeing it, but not Deepfaggot or the flock.

I can't help you see the obvious. I also think you're beyond any red pill wakeup.

-

7 minutes ago, Deephaven said:

Another cop out goal post changed. You've failed to understand covid more than all other people on the board combined.

Enjoying your AIDS meds?You fell for the biggest scam globally co-ordinated on humanity. Govern me harder.

-

1

1

-

-

4 minutes ago, Deephaven said:

If I am blind, show the whole forum. Enlighten us, defend your idiocies.

You failed the basic covid IQ test. There is no more help for you.

-

1 minute ago, Deephaven said:

Yet, you are the blind one following the new hitler. If not, defend something in your thread and prove them to be right.

Or sit back and enjoy the fact you have AIDS.

Actually you're the one who's blind.

Living in the matrix.

-

-

At least the Russians know their government and media is a sham.

Explains you and the flock perfectly.

-

I thought the union voters were all for 81 million.

I heard it here.

-

1

1

-

-

3 minutes ago, Deephaven said:

Ah, the classic response for when Lloyd has nothing. Pussy.

You got conned and are too stupid to realize it.

Continue to triple down.

-

Poor Deepfaggot.

Don't stop now.

-

-

-

No support they say.

-

1

1

-

-

Alvin is Trump's best lawyer.

-

1 hour ago, Steve753 said:

Lloyds cherry picking again.

Biden capital gains tax increase

The capital gains tax rate for long-term capital gains, assets held for more than one year, is at most 20%. Capital gains are the profits you make from selling or trading an asset. The tax rates that apply to a particular capital gain (i.e., capital gains tax rates) depend on the type of asset involved, your taxable income, and how long you held the property before it was sold

Biden’s FY25 budget proposal would nearly double that capital gains tax rate to 39.6%. That proposed capital gains rate increase would apply to investors who make at least one million dollars a year.

'Carried interest loophole'

The Biden budget proposal also revives the debate over the so-called carried interest loophole. Currently, asset managers can treat certain compensation they receive as capital gains, which means that a significant portion of their income is taxed at a much lower rate than if it were treated as wages.

Under Biden’s budget proposal, that compensation would be treated as ordinary income for federal income tax purposes to end the carried interest loophole.

Gambling doesn't count as capital gains?

Remember when 87k irs were hired and were not to go after the middle class.

Pepperidge Farms remembers.

-

A Jar of olives.

-

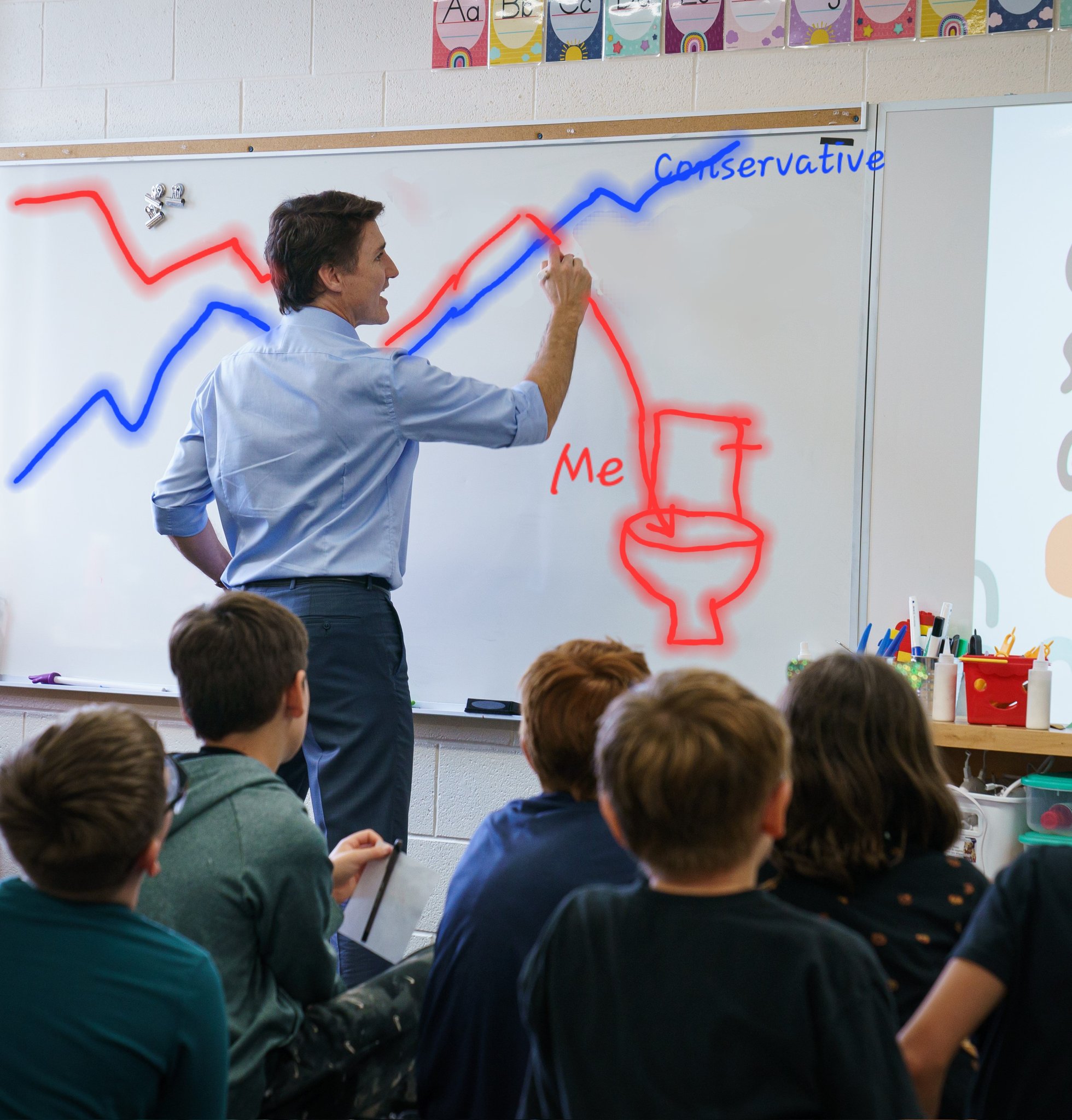

Oh this does not look good.

-

-

Bloodbath.

Poor Fail.

-

81 million my ass.

-

3 minutes ago, Crnr2Crnr said:

the judge doesn't decide if he's innocent or not, the jury of his piers will.

did you recently move here from a foreign country?

Its a kangaroo court moron.

-

3 minutes ago, Crnr2Crnr said:

the judge doesn't decide if he's innocent or not, the jury of his piers will.

did you recently move here from a foreign country?

Its a kangaroo court moron.

-

1

1

-

-

1 minute ago, ViperGTS/Z1 said:

These POS union leaders are out of touch......most of the actual Union membership will be voting opposite...

They don't speak for the members at all.

Karen is too stupid to understand.

How's the Trump CRIMINAL trial going today?

in Current Events

Posted