-

Posts

26,836 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Snoslinger

-

-

1 hour ago, racer254 said:

I figured giving him the link to the tax calculator he should have been able to easily post the screen shots and prove his point. IDK what more can be done.

You making statements like these fucking guarantee you are still lost

and yes skidmark, I am very limited in deductions. Student loan interest, which is also capped at $2500 max. So I couldn’t deduct much there either

-

2 hours ago, racer254 said:

I went and proved my point with an actual New York state tax calculator rather than speculation and hypothetical examples. Everyone can see that and I posted the link so they can make their own assumptions. Sorry if it ruined the narrative for you. BTW, your numbers were a little off according to it as well, but I didn't figure you would believe that either.

All you fucking proved is that

1)I was off a little in the state taxes, which had nothing to do with the point

2) you are a dumb fuck, although that’s been known for a long time. There is no way you’re an engineer either, unless you’re driving the kiddy train at the local mall

-

2 minutes ago, Highmark said:

I stated earlier my assumption is the tax calculator figures the best method and applies that deduction. The whole idea of a calculator is for it to figure those things for you. Again I do not know how this particular calculator is doing it.

Well if you were smart, you’d plug in 24k, then something higher, to see if it changes. It does. That calculator is assuming you actually had $40k in valid deductions, which was not the case

-

24 minutes ago, racer254 said:

Why are your "examples" never completely truthful? Always hypothetical......because they are a fucking narrative and the bullshit that you spew is always like that. Even with your bullshit here you can't seem to get it to correlate fully with the narrative. You're grasping at straws to make it work and if your actual numbers were close you should have been able to plug something close in the calculator and come up with it fairly easily. it's just the shit like this that shows how pathetic some are to make it look worse than it actually is....VICTIMS of tax cuts.

You are beyond the stupidest mother fucker in the forum. It’s the country. I have you an example so you could see the problem. I did not look up the fucking state taxes in my area. Not only is it unimportant in the point, they’re not that fucking far off from reality. Especially in other areas of NY. So continue looking like a fucking dumb ass. You are beyond help. Anyone with a clue about taxes, and there are a few, sees your blatant stupidity. I should have known you’d never understand this, considering you couldn’t even do a simple tax bracket question when noggin and I asked you to awhile back.

-

23 minutes ago, Highmark said:Strange that your tax equations is so much different from the calculator. That's all I'm saying.Enter your financial details to calculate your taxes 160K, 13201 zip 40K itemized. 2 personal exemptionsHousehold IncomeLocationFiling StatusSingle Married

Advanced 401(k) ContributionIRA ContributionItemized DeductionsNumber of Personal ExemptionsYour 2018 Estimated State Income Tax: $6,967Your Income Taxes Breakdown

Tax Type Marginal Tax Rate Effective Tax Rate 2018 Taxes* Federal 22.00% 10.47% $16,746 FICA 1.45% 6.43% $10,281 State 6.33% 4.35% $6,967 Local 0.00% 0.00% $0 Total Income Taxes 21.25% $33,994 Income After Taxes $126,006 Retirement Contributions $0 Take-Home Pay $126,006 * These are the taxes owed for the 2018 - 2019 filing season.

Changes to Your Federal Income Taxes Under the 2018 Tax Reform

$0$10k$20k$5k$15k2017$17,6862018$16,7462017

$17,686- Your marginal federal income tax ratechanged from 25.00% to 22.00%.

- Your effective federal income tax ratechanged from 11.05% to 10.47%.

- Your federal income taxes changed from $17,686 to $16,746.

Why are you putting in 40k for 2018? I am limited to 25 K in my example, because of the limitations I mentioned

-

9 minutes ago, NaturallyAspirated said:

I wonder what Trump's charity % is at?

Neal

-10%

-

5 minutes ago, NaturallyAspirated said:

Weren't the $2000 increase example and his 2% claim different? One was example, the other his personal number.

Neal

yes. i thought i made that clear.

-

so what's next? since you couldn't grasp the insignificance of the state income changes

-

5 minutes ago, racer254 said:

You punch it in and show a screen shot. FFS, it's up to you now. I showed you where and why I didn't believe what you said.

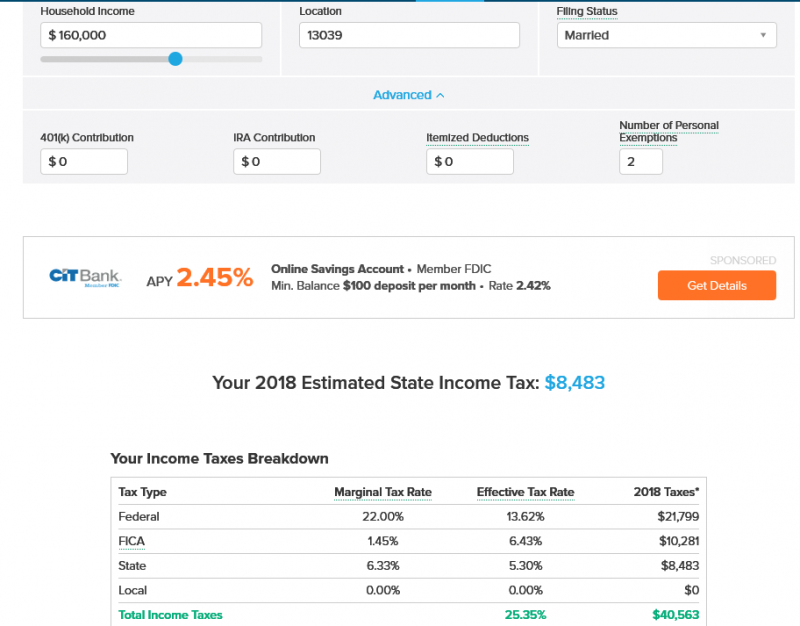

evidently i didn't update the new numbers after opening rigid's leak to another area in NY. my bad, although it doesn't matter really. so in syracuse, someone making $160000 pays $7200 in state income taxes. i rounded down to $40K in my 2017 deduction example, from $43000. so plugging those new numbers into the tax equation, i would have paid $118,685 in 2017, and this year $21, 579. so i paid more this year, because i could deduct less. do you understand this yet, numbnuts?

-

2 minutes ago, racer254 said:

Any tax calculator to prove your point. You can't get 10k in NY state income taxes making 160k so that part of your hypothetical example is bullshit.

i already stated to punch in the fucking new number of $8500!!!

guess what, dumb ass? id still pay more in taxes than last year.

-

Just now, ArcticCrusher said:

aren't we discussing state income taxes here, what racer is questioning? why doesn't he just plug them into the tax formulas?

-

3 minutes ago, racer254 said:

Why don't you show me with a screen shot. I already showed you plenty of the hypothetical incomes that screw up your examples. It's on you now.

a screen shot of what? i am not showing you anything in regards to my income or taxes.

-

Just now, Snake said:

Do you pay your hypothetical tax bill with a hypothetical check?

nope. i sent in a real check, for the first time ever yesterday. ive always had return money

-

-

wtf is racer trying to prove exactly? i told you what state income taxes on someone making $160K in that example would pay. yet he's still posting up unrelated matter.

-

3 minutes ago, ArcticCrusher said:

Nah, its fun watching you make a fool of yourself, again.

only i'm not....

-

1 minute ago, ArcticCrusher said:

I'm not to familiar with your tax system, but calculators usually don't lie.

I use them all the time to do a quick estimate on mine, but then there are many other details I leave out.

Use the calc and post it Mr. tax expert.

well then you should probably stfu, again.

-

Just now, Snake said:

I don't take UPS deductions.

Sorry Pal, I ain't gonna pay for your stupidity.

sure, sure....

-

1 minute ago, Highmark said:

I'm simply going off the calculator. What is unknown on it is how it handles the itemized deductions.

i just showed you the way to calculate taxes, and the formula used. plug in $8500, instead of my $10,000 and see what happens between the two years. are you seriously incapable of doing that?

-

Just now, ArcticCrusher said:

You're trying to fudge the system to show one example of where you don't end up ahead.

there are plenty of examples. here i thought you had a little sense, but god damn.

-

Just now, racer254 said:

Prove your fucking example. It seems this happens all the time with you, bitch slapped.

-

Just now, Highmark said:

Dude I have to DRAMATICALLY drop the income with $43K in deductions to get more federal taxes this year than last.

omg

you are still lost, just like racer. and you're a business owner

you are still lost, just like racer. and you're a business owner

-

1 minute ago, racer254 said:

I don't have the mental capacity because I don't follow a false narrative? That is ironic don't you think? The NY calculator is right there, prove your example.

it's not a false narrative you dumb fuck. i just showed you the new income tax number. now get busy and tell the class what happens at the end. or dont you know how?

-

Just now, Highmark said:

Without question the calculator is not on his side.

Just the single filing that he just posted was almost $2000 more in state taxes alone.

and how does it come out "in the wash"? you clowns really don't know jack shit about taxes

Fake news tries to cover for leftists and Muslims cheering Notre Dame fire

in Current Events

Posted

does anyone other than jtssrx watch this stupid ass shit? My god